unlevered free cash flow calculator

The last formula can be used in the service industry to calculate the sales revenue of the firm. Firstly determine the total revenue of the company which is the first line item in the income statementOtherwise the total revenue can also be computed by multiplying the total number of units sold during a specific period of time and the average.

Dividend Discount Model Gordon Growth Model Efinancialmodels Dividend Investment Analysis Financial Analysis

The formula for net operating income can be derived by using the following steps.

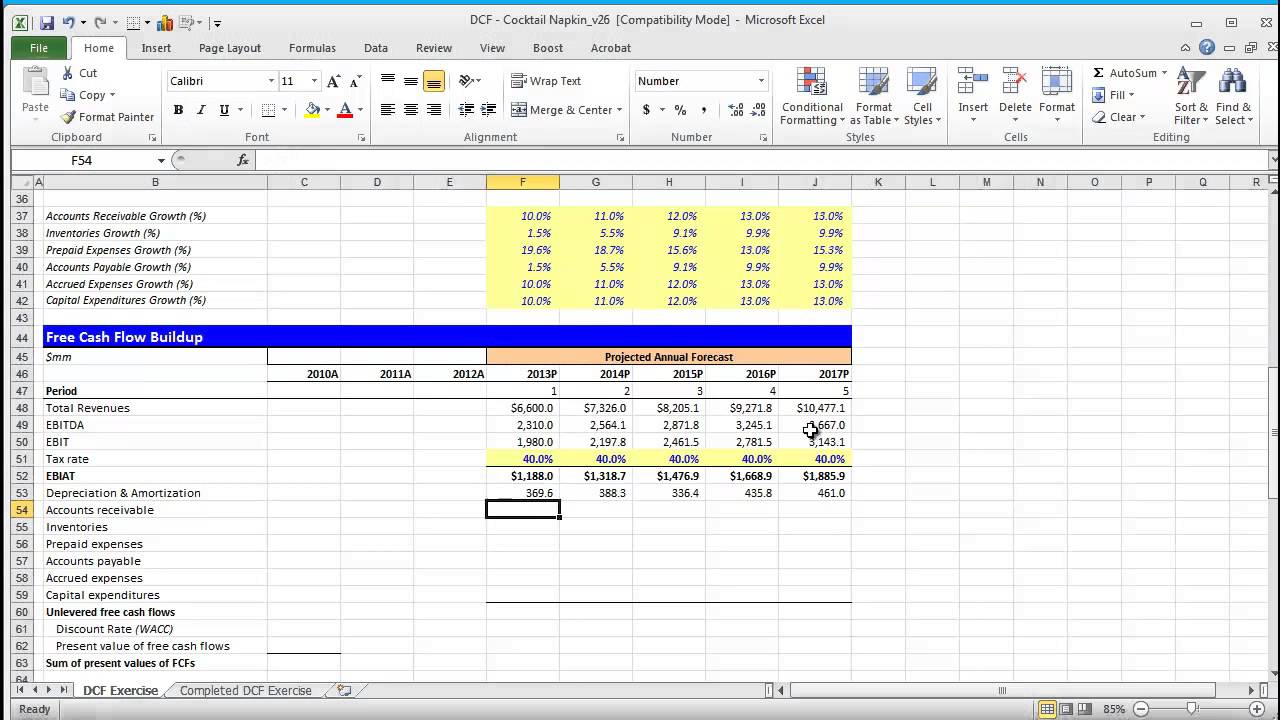

. Apple Sheet PDF Explanation. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

The above formula is used when direct inputs like units and sell value per unit is available however when product or service cannot be calculated in that direct way then another way to calculate sales revenue is to add up the cost and find the revenue through the method called absorption.

Public Provident Fund Ppf Public Provident Fund Schemes Taxact

Advantages And Disadvantages Of Equity Valuation Investing Equity Accounting And Finance

Churn Rate Formula Calculator In 2021 Churn Rate Rate Revenue

Discounted Cash Flow Analysis Example Dcf Model Template In Excel In Stock Analysis Report Template 10 Professional Stock Analysis Report Template Templates

Advantages And Disadvantages Of Equity Valuation Investing Equity Accounting And Finance

Discounted Cash Flow Dcf Valuation Model Excel Tutorials Cash Flow Excel Templates

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

Understanding Key Financial Ratios Efinancialmodels Financial Ratio Accounting And Finance Business Finance

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial